When trading in stocks, bonds, and other securities, a brokerage is the url to the capital markets. Your broker provides access to trading services and information through its pricing and market data software.

In addition to offering trading services, your broker must operate as a market maker to supply quotes for customers at competitive prices. As an organization, your broker needs to complement buyers with sellers efficiently.

If you being an investor are unhappy with the service you get from your broker, you could look elsewhere. Your new broker might have better pricing and use of more securities than your old one.

For this reason many investors demand effective broker latency from their brokers to minimize any potential time loss if they trade in the capital markets.

What Is Broker Latency?

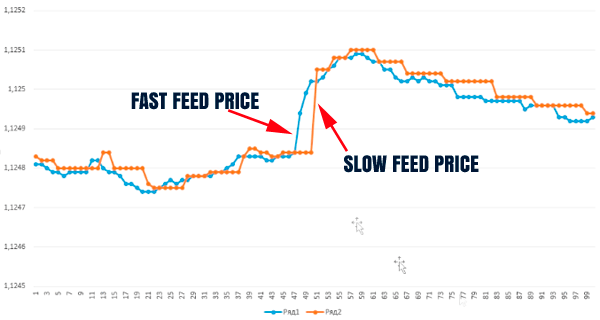

Broker latency is enough time that passes between when you initiate a trade and once the broker receives and fills the order from the exchange. This really is relevant because high broker latency could cost you time and money.

In low latency trading, you being an investor experience less latency whenever you put in an order to buy a stock. In addition, you experience less latency when you put in an order to market a stock. Broker latency is different from exchange latency.

The exchange is where in actuality the broker and your trading software connect to facilitate the trade. The exchange is not active in the trade itself.

Benefits Of A Low Broker Latency

- Reduced Time to Enter and Exit Trades: If you have a low broker latency, you will have to wait less in between trades. That means as possible enter more trades per hour and exit trades in less time.

- Reduced Trading Costs: When you yourself have a low broker latency, you'll have to attend for less among trades. That means that you should have fewer trading costs. You'll pay commissions and possibly a fee to trade in your brokerage account.

- Increased Returns: When you yourself have a low broker latency, you should have less time and energy to enter orders and be less likely to cancel orders. Which means that you'll have more opportunities to put winning trades. Additionally you will be less inclined to cancel orders.

kindly visit the site at https://fxvps.biz/broker-latency/ to get the more details about broker latency.