During the early days of the Internet, most of thematerialslocated online are provided for free, either by differentorganizations or universities. As the years go by, the Internethas actually experiencednumerousdevelopments. Onesignificantconsider the evolution of the Internet is thecustomers'capability to purchase, sellas well as advertiseservices and products, a concept that is moregenerallydescribed as "e-Commerce".

As theappeal of theNetcontinually grows, it is only natural for theweb contentcarriers tobeginsearching for differentmethods of making money from the content that theyrelease online.Generally, there are threemeans forindividuals to earn money from content; one iswithmarketing.Below, theweb content isreadily availablefree of charge;nevertheless itfeaturesparticularadvertisements orweb links to theirenroller sites.

Anothermeans forweb contentservice providers togenerate income is by charging subscriptions,in whichcustomers are required to pay a certainquantityfor access to thematerial for aparticularamount of time. Thedisadvantage to the subscriptionversion is that it onlyprovides oneselection to the consumer-- either they do not pay themembershipand alsothereforeobtain noweb content or pay asignificantcharge to get all the content.Sometimes, thissort of choice led thecustomers to move on to sites thatuseweb contenttotally free. Meanwhile, the3rd form ofprofits isviacontributions that aregotten by thematerialsuppliers themselves.

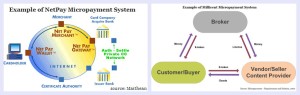

Nevertheless, in 1998 a4th form ofearnings wasrecommended-- the micropayment system. Theprinciple of micropayments would notwanetotally,neither would ittotally come to life. What are micropayments, exactly? Micropayment isnormally defined as theways ofmoving small amounts of money ( typically indimes, nickel or dimes),normally inbuyingelectroniccomponents like music, movies, gamesas well as others.

Because charging such small amountsvia thetraditionalsettlement system like credit cards is impractical, the micropayment system is afeasible option for thoseweb sites thatwant to go " mini". Theprimarygoal of micropayments is to target a highquantity ofcustomers byusing content at afairlysmall cost. It is also usual for micropayment systems to accumulatenumerousrepayments and thenbill it in onenormalsettlement.

A lot of micropayments advocatessecurely believe that the micropayment system is theservice to thecomplimentarybikertrouble for those sites that areexclusivelybased onmarketing. As forweb sites that arebilling subscription fees, micropayments will be afeasibleoption in order to increase thevariety of their consumers.

However, regardless of all the benefits that micropayment systems seem toprovide, its popularityamongst thecustomers did not quite catch on for quite a time. This ismostlybecause ofjournalismnegative aspects that micropaymentcritics are quick tomention.Many micropayment systemcritics insist that micropaymentswould certainlytrigger inconvenience rather than convenience to consumers. How so?One of the mostpreferreddebate used is the "mentaldealexpense".

What does mentaldealpriceimply? Well, this is where acustomer stops andhesitates whether the content isin fact worth therate,no matter howlittle the price is. Thismightreduce the number of yourclient,given that moreindividuals are likely togo withcomplimentarymaterial.

The peoplepressing micropaymentsthink that the dollarexpense ofproducts isthe important things mostin charge ofdispersing readers fromacquiring content,which a reduction in price to micropaymentdegreeswill certainly allowdevelopers to begin charging for theirjob without deflecting readers.

One morefeasibledownside to using micropayment systems is that it requires the consumer tomake use ofsignificant credit cards.Bear in mind thatNet consumers arefairly diverse in age;for that reason, you can notpresume thatevery one of them would havebank card.Given thatyoung adults are under theadultness, they do not havebank card. Moreover,also among thosecustomersstaying inextremelyestablished countries, noteverybody has abank card,and alsoloaningsomebody else'sbank card just to read a certainpost in theWebwould certainlyconfirm to be a bigaggravation.Basically, micropayment systemscanquite possibly alienate thosecustomers who do not havecharge card.

So with all thesenegative aspects, why do we need micropayments? With the growingneed forangelicitems (like information) ininternationaleconomic situationsas well as theirinstantdistribution at aaffordable, thepopular payment methods seemed to be impractical. Since mostinfodiscovered online (Web pages,Internet links, etc)expense barely adime, theprice ofbutting in thecommonsettlementtechniquewould certainlyend up beinga lot morecostly than the actualitem. Thus, micropayment is apracticalchoice.

Agreat deal of contentsuppliersconcurred that micropaymentsuse them thechance toreclaim theprice of online publishing,alsoperhapsearn money, that is, if they arepreferredsufficient. At present, contentsuppliers see theiron-lineappeal as adrawback since their popularity requires them tospend forhugequantities oftransmission capacity. Anotheradvantage that micropayment systemsuse contentservice providers is thechance to betotallywithout sponsorshipas well as advertising, whichuses themmuch moreself-reliance. Withoutpromoting theservice provider could concentrate onpostingproducts thatrate of interests theircustomersrather than what interests their advertisers.

Micropayment systems are showingindicators of recoveryjust recently, what with theestablishing of Apple's iTunes $0.99 a-song, theversion is finallyrevealing someindications of life. Furthermore, reports on the state of the paid content marketreveals that,material purchaseslisted below $5raised 707% in 2002. A veritable accomplishment,because it made a seven-fold leap frombasically nothing.

Although,numerous people find the notion ofacquiring $.99tracks at iTunes attractive, Apple's administrators themselves admitted that mostcustomers stillfavor purchasingbigger album packages instead of the pertrackacquisitions. After all,Webindividuals do notacquireweb content as if they were aitem ofsweet. Some micropayment solutions evenconfess that theirconsumers arefillingmuch less moneyright into their accounts than what they initially expect whichsuggests that asubstantial barrier stillstays.Currently, whether the micropayment system will eventuallylocate successthis moment around or not will stilldepend upon thecustomers' behavior, a hurdle that is yet to be crossed.