Owning a Home Helps Protect Against Inflation You & rsquo; re probably feeling the impact of high inflation every day as costs have actually increased on groceries, gas, and more. If you & rsquo; re a renter, you & rsquo; re likely experiencing it a lot as your lease continues to increase. In between all of those elevated costs and unpredictability about a potential economic downturn, you may be wondering if it still makes sense to buy

Freddie Mac discusses how:

“& ldquo; Not only will buying today help you start to build equity, a fixed-rate mortgage can stabilize your monthly real estate expenses for the long-lasting even while other life expenditures continue to rise –-- as has been the case the past couple of years.”& rdquo; Unlike rents, which tend to rise with time, a fixed-rate mortgage payment is foreseeable over the life of the home mortgage (usually 15 to 30 years). And, when the expense of most whatever else is rising, keeping your housing payment stable is particularly crucial.

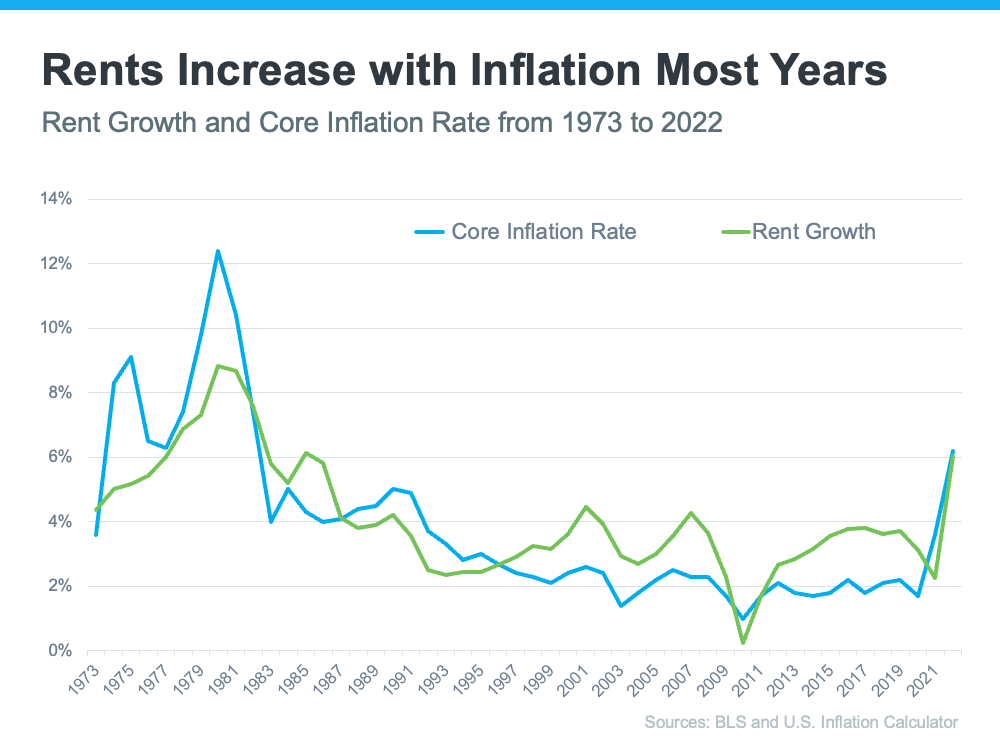

The alternative to homeownership is leasing –-- and leas tend to move together with inflation. That suggests as inflation increases, your regular monthly rent payments tend to increase, too (see chart listed below):

< img alt=""data-image="https://images.squarespace-cdn.com/content/v1/5b9ada8b2714e5f76f88a8a3/71a16137-bf0b-45c0-b9ab-4a452dfaad42/rents-increase-with-inflation-most-years.png"data-image-dimensions= "1000x750"data-image-focal-point="0.5,0.5"data-image-id="646e2ee9e02a246ccabf87d3" data-image-resolution ="1000w"data-load="incorrect" data-src ="https://images.squarespace-cdn.com/content/v1/5b9ada8b2714e5f76f88a8a3/71a16137-bf0b-45c0-b9ab-4a452dfaad42/rents-increase-with-inflation-most-years.png" data-type =" image "src="https://images.squarespace-cdn.com/content/v1/5b9ada8b2714e5f76f88a8a3/71a16137-bf0b-45c0-b9ab-4a452dfaad42/rents-increase-with-inflation-most-years.png?format=1000w"/ > A fixed-rate home loan permits you to protect yourself from future rent hikes. With inflation still high, when your rental agreement turns up for renewal, your residential or commercial property supervisor may choose to increase your payments to balance out the impact of inflation. Possibly that’& rsquo ; s why, according to a current study, 73% of home supervisors plan to raise leas over the next two years.

Having your largest month-to-month expense remain stable in a time of financial unpredictability is a significant perk of homeownership. If you continue to lease, you don’& rsquo; t have that exact same benefit and aren’& rsquo; t as secured from rising expenses.

Bottom Line

A steady real estate payment is particularly essential in times of high inflation. Let’& rsquo; s connect so you can discover more and start your journey to homeownership today.